Ten Predictions for 2021, Part 1: SPAC Edition

2020, on the whole, has been miserable. I suspect 2021 will be much brighter as the vaccine rolls out and the world normalizes.

So I've been thinking a lot about 2021, and I wanted to put out some predictions for the year. But I've also been a little obsessed with two things recently: the SPAC bubble and cruise lines, and my predictions centered heavily on those two themes.

With that in mind, I decided to make 10 predictions for 2021. Today, I'm releasing my first five. All five of these are themed around the current SPAC bubble. Tomorrow, I'll release my five non-SPAC predictions for 2021 (update: it is now posted here); while there won't be any SPAC predictions in there, you can bet there will be some discussions of cruising!

With that in mind, here are my five SPAC predictions for 2021.

Tons of SPACs liquidate without successfully completing deals

An enormous wave of "red flag" SPAC deals see their share price collapse post-merger

Whether the SPAC bubble collapses or not, we'll see more "celebrity" SPACs and they will continue to do incredibly well

Along those same lines, SpaceX will go public through a SPAC, and it will be the best performing SPAC of all time.

The owners of White Claw and Bang energy drink will join them!

Current EV boom ends in tears

Prediction #1: Tons of SPACs liquidate without successfully completing deals

I have written extensively on SPACs. I've called them the most ludicrous bubble we'll ever see, and I stand by that (though I'm also willing to profit when the ludicrousness works in my favor!).

PS- the paper "a sober look at SPACs" has been making its way around; it's well worth a read. I've said for a long time the incentive structure and fees in a SPAC are awful; the paper breaks down just how awful and it's worse than I thought.

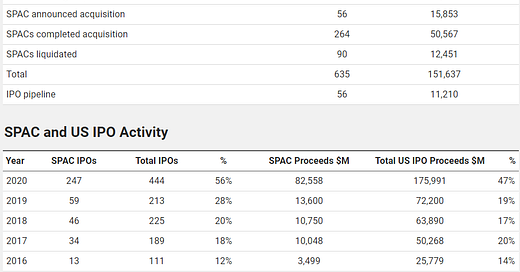

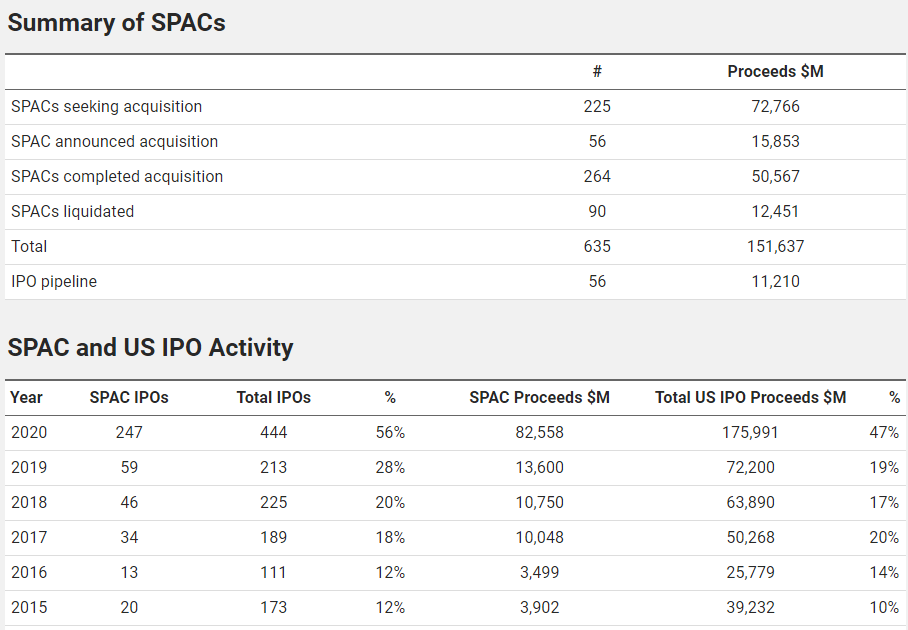

In 2021, I think we start seeing parts of the SPAC bubble collapse on itself. Why? There are so many SPACs IPOing that I just don't think they'll all be able to find targets. As I write this (on December 24, Merry almost Christmas!), 247 SPACs have IPO'd this year, raising about $83B (judging by my inbox, I wouldn't be surprised to see another 30 IPO before year end, but we'll ignore those). Per SPAC analytics, that's more than the total IPO market in each of the past five years; heck, it's more than triple the 2016 IPO market and more than the 2016 and 2015 IPO markets combined!

That's simply an enormous amount of capital looking for deals. Remember, SPAC deals often include some debt and a founder equity rollover; all in, I would guess the ~$80B of SPAC IPO money represents well over $200B in potential deals (honestly, given the valuations SPACs are willing to give targets and the way they structure with limited floats, you could say that $80B represents over a trillion in deal capacity). There simply aren't enough public ready companies to absorb that much capital. Towards the back end of 2021, a lot of these SPACs are going to be reaching the end of their life, and they are going to start announcing agreements with increasingly ridiculous companies in an attempt to get a deal through and preserve their founders shares. Eventually, these deals will get voted down, and the SPAC bubble will collapse.

Now, you might say, we're already seeing SPACs announce deals to buy pre-revenue companies that won't make anything for several years yet are getting multi-billion dollar valuations. That's pretty ridiculous; how could deals get worse than that? And, if shareholders are willing to vote for those ridiculous deals, what won't they vote for? If shareholders will vote for anything, how does the bubble pop? Which leads me to my next prediction....

Prediction #2: an enormous wave of "red flag" SPAC deals see their share price collapse post-merger

As the current wave of SPACs matures, we're going to reach the point where there are no more "public ready" companies to merge with, so the SPACs will increasingly reach and do deals with less and less due diligence and more and more red flags (I would suggest we've already hit this point!). Once these companies go through the SPAC'ing process and their floats clear up a little, tons of these companies are going to be revealed to have huge issues (likely through activist short reports). The stocks will crater.

This point is important for prediction #1; right now, shareholders will vote through basically any SPAC deal because basically every deal makes money. 2021 will change that; a ton of deSPAC'd companies will be subject to credible short reports that reveal lots of red flags and see their share prices collapse. After shareholders have been burned a few times, we'll see them start to get a lot more selective with what deals they vote through.

I think we've already seen a huge wave of the "red flag" SPAC companies, so I won't detail them here (Nikola and Triterras would be perfect examples). But I think the "rushed DD" angle might be a little missed here, so I'll give a current example: GIX. They announced an LOI on October 27 to merge with one company. The market didn't love the deal, so GIX turned around and entered a definitive agreement with a completely different company on November 23. Seriously: the CEO said that the market didn't love their first deal, so they turned around and switched deals inside of a month. From up close, that seems totally normal: if a company I owned announced a merger I hated, I'd love if they responded to feedback and backed out of it. But, if you just think about that deal with GIX's SPAC timeline in mind, it's insane. GIX IPO'd in June 2019 with 18 months to get a deal done. The SPAC was set to expire in December 2020, so they were running up against liquidation. To effectively announce two separate deals within a month as they press up against expiration reeks of desperation (in fact, they specifically highlighted the first deal with Bolder in their proxy asking for an extension!); I will be very interested in reading the background of that merger process. How much DD could GIX really could have done to announce a second merger within a month? The combination of a need to get a deal done and a rushed process means the DD was probably very light.

Look, I'm no expert on GIX or the telehealth industry (which is where their second deal is), so I'm not saying anything about this company in particular. I'm just highlighting how the DD process for SPACs can get very, very rushed given the timelines as a SPAC approaches expiration, and rushed DD often means that a lot of red flags don't get uncovered. Just because the red flags weren't uncovered in a rushed DD process doesn't mean they go away; eventually, they'll pop up, and my guess is they pop up in an activist short report or when the company reports a string of awful earnings reports that dramatically miss projections. Tons and tons of SPACs are going to make for very juicy short targets on the back end of this bubble (disclosure: nothing on here is investing advice).

PS- as I prepped to post this, TTCF granted RSUs to their CFO. The first tranche vests if the stock is >$19 in October 2021.... that's ~22% below the current share price. TTCF was the subject of a short report a few months ago; I have no views on the short report but I do think a company giving RSUs that vest if the stock drops 22% inside of 10 months are indicative of a company that knows their shares may have gotten swept up in a little bit of a mania. I'd guess a lot of former SPACs are in similar positions (disclosure: we were an investor in Forum's founders' shares, and we continue to hold a small position in TTCF from the founders' shares)

Prediction #3: whether the SPAC bubble collapses or not, we'll see more "celebrity" SPACs and they will continue to do incredibly

In general, the SPAC structure makes it really, really difficult to short them, which is one of the reasons I think many have performed so well. These things are often taking companies public at multi-billion dollar valuation with free floats of only a hundred million or so. That's tough to short; it's even tougher when you factor in the SPAC warrants that create an arbitrage opportunity. The combination means these SPACs often have literally no borrow.

Why does that matter? It kind of struck me when I read the article "how offshore oddsmakers made a killing off gullible Trump supporters." Ignore the politics for a second; what happened there is people were really passionate about a cause (Trump), and one way they showed that passion was betting on him, which drove the odds to crazy levels as there wasn't really the same passion on the other side. SPACs have something of a similar dynamic. Passionate about climate change? Show that passion by buying that latest EV SPAC deal, price and valuation be damned.... and the lack of short borrow means that there's no one on the other side.

I think eventually that craze will die out (again, see point #2). But I think "celebrity" sponsors that have done good deals before will continue to benefit from this dynamic. The headliner here is obviously Chamath and his IPO series of SPACs; as I write this, his first two SPACs (which are now SPCE and OPEN) trade for ~$27/share, and other deals he's been associated with trade for huge premiums as well. Eventually, that music will stop (no one can create that much value instantly through multi-billion deals every time), but I doubt it's in the near term. Every deal he announces will be a celebrity deal, and people who made money on his previous deals will buy them sight unseen on his word and their passion for his vision.

Other SPACs that could qualify here? Bill Ackman's PSTH (I wrote about their options here), Lux's SPAC, and Virgin's SPAC are super obvious candidates (RBAC may qualify). I think we'll see a lot more in 2021; Liberty and Softbank are launching SPACs that will likely qualify (and I wish IAC would join them!), but I think we'll start seeing more retail oriented super investor SPACs. For example, every single "shark" on Shark Tank should very obviously launch a SPAC, as they'd certainly get this star treatment (Mark Cuban in particular would mint money in a SPAC). I would bet we see at least three SPACs launched by CNBC celebrities (I'll lump sharks into the CNBC celebrity bucket, but you could get really creative here. Why not launch a food themed SPAC backed by a Top Chef judge?). I'll also bet we see three SPACs launched with some loose ties to the Trump administration; I would not be surprised in the least if we saw one of the Trumps launch a SPAC or at least be involved with the PIPE into one. Someone with loose ties to Berkshire / Buffett will absolutely launch a SPAC trumpeting that connection, and it will do phenomenally (Boston Omaha / Yellowstone loosely qualifies here, but I think we'll get a way more explicit one in 2021).

Bonus prediction: One of the Fox News contenders (OAN, Newsmax, a few others) rides the dynamics above to go public through a SPAC to great success, possibly with a Trump backing it. It will be an absolute bonanza for the sponsors and, if backed by a Trump, will create a company with the resources and brand to actually compete with Fox.

Prediction #4: SpaceX will go public through a SPAC, and it will be the best performing SPAC of all time. Vital Pharma (owners of Bang energy drink) and Mark Anthony Brands (owners of white claw) will join them.

Pretty self explanatory. Elon is a master of giving the public markets what they wants, and if he merges with a SPAC, I'm not sure there's a limit to how high it will trade.

Why would Elon merge with a SPAC? Elon's traditionally been equity rich but cash poor; merging with a SPAC will let Elon get several hundred million in cash while structuring SpaceX to go public on his exact terms and valuation. Those terms will be rich and exacting, and the market will not care. I would not be surprised to see SpaceX float 1% through a SPAC at $100B valuation (a premium to its last round) with Elon maintaining total control, and then see the stock trade through a $700B valuation on announcement.

Bonus Elon prediction: if SpaceX goes public and the share price goes bonkers, every other business tangentially related to Elon will SPAC within 6 months.

Related prediction: every consumer company that is private and has a good brand will go public through a SPAC, because SPACs desperate to merge will offer consumer brands deals and valuations too good to say no to knowing that retail traders will buy into a SPAC merging with a known brand at near any valuation. The top company that comes to my mind here is White Claw; it's honestly a perfect SPAC company. Given the stock market performance of Monster Energy and Celsius, I think Vital Pharma (which owns Bang) and a variety of other smaller energy drink players would have a pretty easy story to sell and be well received, even at monster valuations (pun intended). Nextdoor is rumored to be looking to IPO; that's an obvious SPAC candidate as well.

Prediction #5: Current EV boom ends in tears

2021 sees the collapse of the current EV bubble. NKLA, HYLN, and a ton of others have valuations in the billions despite having never made anything and often having extremely credible short reports that point out massive issues at the companies.

What causes the bubble to collapse? There's just too many of these companies with valuations that are much too rich. As 2021 progresses, the lock ups for these stocks expire, and the market will be flooded with insider selling and secondary offerings. As their floats expand, their valuations will collapse given that many of these "businesses" are closer to ideas than actual operating companies at this point.

I don't have more to add here. I wasn't around for the tech bubble, but I feel like the SPAC EV bubble has to be crazier. The SPAC EV bubble is companies literally announcing "we have decided to sell a major piece of our business for $X billion" and the market waking up the next day and deciding that business is worth 5x (almost without fail). I know that valuations for tech stocks was insane and the pop on adding "dot com" to your name was huge, but having the market value companies at 5x the price they've juts announced as fair is wild, and it will end badly for investors left holding the bag.