Some things and ideas: December 2020

Some random thoughts on articles that caught my attention in the last month. Note that I try to write notes on articles immediately after reading them, so there can be a little overlap in themes if an article grabs my attention early in the month and is similar to an article that I like later in the month. Writing earlier in the month is a particular challenge for an environment as wild as COVID; for example, if I link something from early April like "Apple tells staff stores closed until early May or "Equinox won't pay April rent," by the time I post those articles in late April the information is wildly out of date (people will be more concerned with Equinox paying May rent!) even though it's super interesting!

Don't be like David from the Mist

The ending of The Mist movie version is pretty unique. With their town overrun by monsters, David (the film's protagonist / father) and a group of survivors (including his son) try to escape. Their car breaks down, and rather than die a horrible death at the hands of the monsters, they all agree to kill each other quickly. However, there are five survivors and four bullets, so David kills everyone and then prepares to meet his (horrific) fate at the hands of the monsters. Just then, a military van pulls up and reveals that everything is under control. It's tragic: if the group had just waited two more minutes, every one would have lived. Instead, David killed everyone, including his son, and he'll have to live with that for the rest of his life. It's a pretty unique (and sad) ending for an otherwise unremarkable movie (~70% on rotten tomatoes). How unique? I haven't even seen the movie, and I still know about the ending because one of those Facebook clickbait "most surprising movie ending" articles mentioned it and it stuck in my brain.

Why do I mention the Mist's ending? I know you're tired of being cooped up because of COVID; I certainly am! We all can't wait to go hit a karaoke bar, do an escape room, go to an NBA game, or just travel with our best friends. But we all need to wait just a little bit longer until the army arrives (or, in this case, until you've gotten vaccinated).

Tough way to start a monthly links article; I know. But I also have ~10 friends who have lost parents to COVID, and I know of a ton of other people (including family members and very close friends) who have had it and are still suffering (sometimes serious) side effects weeks and months later.

I'm not saying to isolate yourself in your house for the next 3-6 months until you get a vaccine. I'm just saying to be safe, practice social distancing / mask wearing, and keep avoiding the highest risk activities (going to bars, crowded indoor dining, etc.). After ~9 months of semi-lockdown, it's easy to let your guard down and do something "normal." Don't do it; remember, the "monster" is still raging right now: the U.S. has had more than 3m deaths this year (by far the most ever counted), thousands more are dying every day, ICUs remain at max capacity, and the UK strain of COVID spreads terrifyingly quickly and is in the U.S. Don't be like David from the Mist and give up right before help comes; stay vigilant and cautious until you get the vaccine.

Premium / word of mouth

I launched a premium YAVB in April (announcement / overview here), and we updated it (and the rest of the website) with version 2.0 in August. I've had a lot of fun doing the premium site so far; if you enjoy the free blog, I think you'll love the premium site, so I'd encourage you to subscribe.

The general goal of the premium site is to post one deep look at a company and/or investment idea each month, and then do a monthly general update post (kind of like this post, but with a heavier focus on investing specific things, individual investment updates, and my thoughts on them), but it's still a work in progress!

Don't feel like subscribing? No worries! However, one of the reasons frequency of posts / podcasts / other public stuff can fall off is because I look at them and wonder: "Is it really worth my time doing these for this small an audience?" A lot of work goes into all of these, and I hope that the output is generally of interest / high quality. If it is and there's someone you think would like this blog, please share it with them. It would mean a lot; positive feedback / increased readership is what keeps the public posts coming!

This isn't meant to be a threat or anything! It's just frustrating to spend lots of time on something that you think is decently high quality and consistently see viewership numbers that would rival a local high school's newspaper or a North Korea / South Korea soccer match or an Italian soccer match during a pandemic.

And a big thank you to everyone who reached out expressing how much they liked the blog. Honestly it means a lot to me!

One thing I realized after putting this request up for a few months: it's kind of rude for me to be asking people to share my blog without highlighting some other blogs I enjoy. So here's a special shout out:

Premium recommendation of the month: Return on Cap

A really good service that reminds me of scuttleblurb (friend of the podcast!); every time you read one of their posts, you're going to come away feeling like you're a semi-expert on the company / industry.

Honestly, I've enjoyed all of their articles, but to just highlight one: this netflix primer was outstanding (though I took issue with some of it!)

A thought to wrap up the year

Something I've been wondering: for average workers, 2020 was probably the worst year in modern history. But I wonder if this was the best year ever for corporate enrichment?

SPACs (a recent obsession of mine!) are a huge driver here; SPACs are basically a walking way to transfer wealth from shareholders to management teams. Remember: founder's shares mean that SPAC management teams get ~20% of the equity value of any deal that gets approved. SPACanalytics says ~$50B of SPACs have completed deals so far this year; that's ~$10B of equity value that's flowed through to SPAC founders (could be more or less depending on final deal price, how much equity the founders gave up to get the deal through, etc.)

But it's not just SPACs; many management teams made out like bandits providing "rescue" financing to their companies (OSW is a particularly egregious example I highlighted earlier this year). Or a lot of management teams showed solidarity with their furloughed workers by giving up large chunks of their salaries for 2020.... the only catch was the management team's often got rewarded on the back end with stock grants to make them whole (and the stock was often priced at pandemic lows, so they ended up making way more than they would have if they had just taken their salaries!).

Cheesecake factory settlement

Earlier this month, the SEC made a settlement announcement with Cheesecake Factory. The settlement covered misleading investors at the pandemic lows; CAKE agreed to pay $125k and stop misleading people.

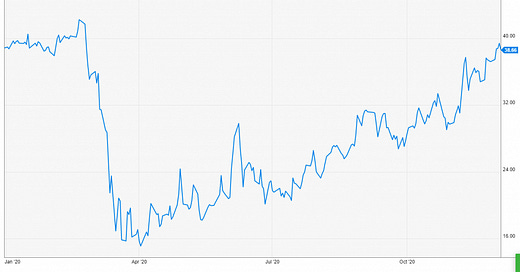

CAKE announced a $200m financing deal in late April; since then, the stock has basically recovered to pre-COVID levels.

It seems like a pretty good trade for CAKE: make misleading statements at the bottom, get $200m in rescue financing, and then pay a slap on the wrist fine months later. I'm sure Roark (who made the rescue financing) got better insight and data than the company's external misleading statements, but given the rescue financing including a convertible preferred, the misleading statements certainly played some role in the pricing of that financing so it's tough to say the two weren't related in some way.

I wonder how many other companies did this (presented a braver face to the market than they had internally); I'm sure the punishment for everyone who is caught will be a slap on the wrist (similar to CAKE's)... but doesn't that set a bad precedent? Business for all of these COVID hit companies remain a complete disaster. There's another world where the markets weren't as wide open as they have been this year, and shareholders in all of these companies are facing massive losses and/or the companies are filing for bankruptcy right now. Would the execs be facing jail time in that scenario? Is the SEC setting a poor precedent for the next crisis; just lie your way through it and we'll give you a slap on the wrist at the end?

People who have followed anything the SEC has done over the past few years will probably laugh at how naïve my shock here sounds.

Here's CAKE's stock price:

Entertainment companies and "undervalued" stocks in strategic deals (featuring Discovery and Oprah)

A few days ago, DISCA and Oprah struck a deal for Oprah to sell the majority of her remaining stake in OWN for DISCA shares. That article noted that, in 2017, Oprah struck a similar deal with DISCA, but she took cash instead of stock in that deal. That got me thinking: was there a signal in Oprah taking cash last time but shares this time? You could paint a picture either way.

If you wanted to take a bullish picture, you'd note that Oprah is a really valued contributor to DISCA. DISCA's partnership with Oprah is probably worth more than the value of just her network; DISCA can go to potential partners and say "hey, we've got Oprah. You can trust us." Oprah shines a brand halo onto all of DISCA. And having Oprah is big for DISCA; Oprah has super fans, and super fans are likely to be the first people to sign up for a new streaming service like Discovery+. So you could say DISCA looks at Oprah as a valued contributor and goes to her and say "hey, we want to be partners with you for the long term. Take our stock and lets grow this thing together; and by the way here's a ton of MNPI to show you that our stock is undervalued and you should want it."

If you've listened to my podcast with Mike from Non-gaap, you'll recognize this argument. It rhymes with the corporate governance shenanigans he uses to find companies who think their stocks are undervalued.

If you wanted to paint a bearish picture, you'd say that Discovery knows their stock's value better than anyone, and convincing Oprah to take overvalued stock is a nice way to pay for any asset.

Maybe you don't think a company would take a key contributor like Oprah for a ride like that. But consider the recent history of another media company, LGF, and two "key contributor" deals they did in 2019.

LGF had the option to give AT&T stock or cash in a payout at the end of 2019. They chose stock worth ~$8.73/share, a slight premium to the share price as I write this. Now, T and LGF are both big boy corporations, but T is also LGF's biggest distributor of the Starz network, so I think LGF would at least think twice before stuffing them with overvalued stock.

In mid-2019, LGF completed their payments for 3 Arts. 3 Arts is a big production company with lots of talent; projects they've been involved with include Its Always Sunny, Master of None, The Office, and a bunch of others. This is a company with a ton of relationships throughout the industry; if you piss them off in a deal, there could be huge ramifications for a freaking movie studio (which LGF is!). LGF could owed 3 Arts ~$166m and could pay stock or cash; they chose stock that was priced at ~$13/share at hte time. Today, that stock is worth <$9.

Or you could take a neutral view: this is a ~$35m transaction. Oprah's worth approaching $3B, and Discovery is a >$30B enterprise. This transaction was a rounding error to both of them; maybe they took shares for the heck of it or because the taxes associated with a cash sale for Oprah weren't worth the headache.

Maybe we can learn something from the 2017 transaction, where Oprah took cash instead of shares? I don't think so; Discovery shares were trading around $19-20 in December 2017 versus ~$27/share today. That performance is roughly in line with the indices, so it's tough to say Oprah really left money on the table or made out well by taking cash versus stock back then. So I'm not sure what to read into the switch.

Maybe this all means nothing. Maybe there's some hidden motivations here. I don't know. But I remain really interested in DISCA as they roll out Discovery+ (see my bullish post from last month), and I want to keep my eyes open for any signs that they might be seeing an inflection point

Two others pieces of DISCA news while I'm here

Mayweather vs Paul

"Social Media Sensation" Logan Paul and Floyd Mayweather announced a special exhibition match; Huddle up had some nice thoughts on it.

I will most certainly not be watching, but I thought the announcement was interesting for a few reasons.

First, it shows something I've been highlighting a lot recently: the internet has made celebrity more monetizable than ever, and that's only going to increase. I wish there was a way to buy a "basket" of 10-20 hard working and young people with huge social media followings; I would guarantee people are going to be shocked by how much money these people can make with enough followers, creativity, and work ethic.

Second, I just thought the pricing structure was really interesting. I've pasted a screenshot below (from earlier this month; it's now moved to the $59.99 point). Early bird pricing is used all of the time, but I've never seen it used for a pay per view or sporting event or anything, and I think it's really clever. $24.99 for the first million tickets is ~$25M of free float that can be used to set up the match and guarantee that it's worth the performers time. It also creates a proof point for advertisers and sponsors ("hey, a million people are really into it and have ponied up money for it; sponsoring it will really resonate with them").

A completely unrelated plug

Since we couldn't be together in person, for Christmas my family booked a virtual magic show with Matt Szat. It was an absolute blast; we had people of all ages (from a ~4 year old niece to grandparents >70 years old) who were raving about the experience.

Yes, this is completely unrelated to anything in finance. I don't get a referral or anything here; just wanted to highlight because we've got another several months till we can freely travel to see our loved ones, and this might be a nice bridge to experience together to get there. We certainly enjoyed it!

Podcasts:

I launched the Yet Another Value Podcast in August. They've been a blast so far. You can follow on Spotify, iTunes, or YouTube (and please be sure to subscribe and rate them if you enjoy them!). This month's pods:

Other podcasts: I went on planet microcap. We talked cruises and generally nerded out.

Other things I liked

Managing movie superheroes is about to get a lot more complicated

I watched WW1984. I have no idea how someone could watch that and think to themselves, "the people who made this movie are absolutely capable of making more movies that make sense and that people want to watch."

Peloton churn (tweet from last year)

I had a lot of people yell at me for my post on Pelton for not including enough bear points. I get the bear thesis; heck, I read their S-1 last year and couldn't believe the valuation then!

Allow me to reintroduce myself

Highly recommended

Outstanding overview; that piece alone is well worth the annual subscription to MBI

See also my interview / podcast with MBI or my pieces on ANGI or response to why FB won't beat ANGI

The SPAC short boom is on the way

Agreed there are a lot of awful SPACs out there. Disagree about MPLN, and disagree about them being good shorts currently (in general, borrow is way too tight).

Speaking of MPLN, NYT article on Congress ending surprise billing

The home of the Sopranos is under siege: inside the battle for the soul of HBO

Why I think John Malone is wrong (on Roku)

Comcast content costs up 10% due to COVID, but positivity rate approaches zero on their sets (link to my own tweet; just interesting)

Flood of daytraders strains online brokers and backlash is swift

Yes, again linking to my own tweet, but wanted to highlight it because it's insane and because of this follow up

US Deaths top 3m in 2020, by far most ever counted

Unbelievably sad

Curiosity Stream is the service you need to quench your thirst for knowledge

Feels a little bit like a paid post, but interesting take on an interesting company that I discussed with Zack Silver on a pod last month!

Cruise to nowhere comes to screeching halt after elderly passenger tests positive for Covid